Pittsburgh Steelers’ Offensive Uncertainty Looms Ahead of 2025 NFL Season

Quarterback Carousel Threatens Playoff Hopes

The Pittsburgh Steelers face unprecedented instability at quarterback as they prepare for the 2025 NFL season. For the first time in franchise history, no quarterback from their 2024 roster remains under contract—a glaring red flag for a team that ranked 27th in passing yards (3,264) last season. This unprecedented turnover leaves the Steelers as the only NFL team without a returning passing leader, creating what analysts call a "developmental black hole" at the sport's most critical position.

The Pickett Paradox

Kenny Pickett's uneven 2024 performance (64.3% completion rate, 94.8 QB rating) failed to cement his status as the franchise cornerstone. While the 27-year-old showed improved pocket presence, his 17 interceptions ranked third-worst in the league. The Steelers now face tough questions about whether to re-sign veteran Russell Wilson (who started six games in 2024) or gamble on unproven talent.

Systemic Offensive Challenges

Ground Game Limitations

Pittsburgh's run-first philosophy (10th in rushing yards) has become a double-edged sword. Defenses routinely deploy eight-man boxes against star RB Najee Harris, who averaged just 3.9 yards per carry in critical late-season games. This predictable approach makes play-action ineffective—the Steelers converted only 28% of third-down attempts via the pass in 2024.

Receiver Room Questions

While Diontae Johnson and George Pickens combined for 1,823 receiving yards, neither established themselves as a true WR1. The lack of vertical threats (only 12 completions over 40+ yards) allowed opponents to compress coverage, particularly in red zone situations where Pittsburgh scored touchdowns on just 52% of trips.

Defensive Pressures Mount

Pass Rush Decline

T.J. Watt's 13.5 sacks couldn't mask systemic issues—the Steelers' total sack count plummeted from 47 (2023) to 35 (2024). With Watt entering his age-31 season and Alex Highsmith's production dipping (7 sacks), Pittsburgh must address edge-rushing depth.

Secondary Concerns

Joey Porter Jr.'s midseason ACL tear exposed alarming coverage vulnerabilities. The Steelers allowed 12.3 yards per completion against playoff teams—a 23% increase from their season average. Cole Holcomb's lingering ankle issues further weakened linebacker support in nickel packages.

Front Office Crossroads

Draft Dilemmas

Holding picks 19-22 in the first round, Pittsburgh faces tough decisions. NFL Network's Daniel Jeremiah notes: "This draft class lacks QB depth but offers potential Day 1 starters at tackle and receiver—both glaring needs." Prospects like Georgia OT Earnest Greene III could help an offensive line that surrendered 49 sacks in 2024.

Free Agency Calculations

With $23M in projected cap space, the Steelers could target veteran QBs like Baker Mayfield or Ryan Tannehill. However, GM Omar Khan's conservative approach (ranked 28th in guaranteed money spent since 2022) raises doubts about aggressive moves.

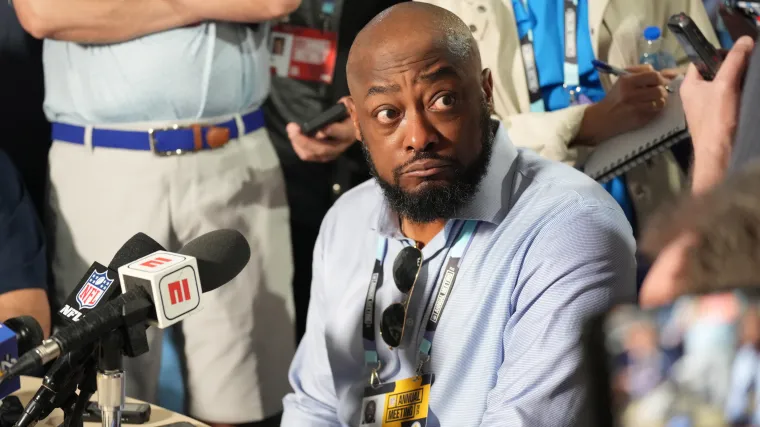

The Tomlin Factor

Mike Tomlin's streak of 18 consecutive non-losing seasons faces its greatest test. The coach acknowledged at the NFL Combine: "We're not naive about our challenges. Every resource—draft, trades, free agency—is being evaluated." Players privately express concerns about offensive coordinator Mike Sullivan's system, which produced the league's fifth-lowest explosive play rate (12%).

Path Forward

The Steelers' 2025 success hinges on three critical moves:

-

Resolving quarterback uncertainty before training camp

-

Upgrading offensive line talent through draft capital

-

Adding defensive speed to counter AFC North rivals

With divisional opponents Baltimore and Cleveland both making offseason upgrades, Pittsburgh's margin for error shrinks daily. As preseason approaches, the Steel City faces its most pivotal roster rebuild in decades—one that could define the franchise's trajectory for years to come.